Private Loans

The Private Loans Import/Export feature in PowerFAIDS performs a variety of functions to track non-Federal student and parent loan data from a variety of lenders and service providers.

Using PowerFAIDS to manage private loan information provides:

- Ability to batch send and reconcile data: Using PowerFAIDS, you can streamline awarding private loans by using batch to export application send files rather than going through each service provider's page individually.

- Ability to set and manage guarantors, lenders, programs: To help streamline the awarding of private loans, you can set and forgot the various guarantors, lenders, and programs students and others at your institution frequently use to borrow private loans directly from the Private Loans Import Dashboard.

- Ability to run in simulation mode: In addition to running in real mode, the process can be run in simulation mode. Regardless of the mode, a results report is available at the end of the process. The results report provides you with the status of each award and, if applicable, the reason(s) it wasn’t successful.

Expand each section below for additional insight on how various PowerFAIDS features and processes interact with private loans.

Programs, Lenders, & Guarantors

Programs, Lenders, and Guarantors must be created in PowerFAIDS using an ID and Name. You can create them in advance based on historical data, or you can create them as Certification Requests are received. These entities can be created and managed from Import/Export > Private Loans > Import, under the Manage menu.

For more information, see the following articles:

Fund Setup

When creating private loan funds in PowerFAIDS, consider using one of the following models:

Option 1: One fund for all student loans & one fund for all other loans

Use one fund for awarding all private loans where the student is the borrower and one fund for awarding all private loans where someone else is the borrower. In this model, do not associate the program, lender, or guarantor to the fund itself; you will instead associate them at the individual award level the student record.

In this example, you would use two private loan funds for awarding all private loans, one for student loans and one for parent/other loans. When you set up the loans, you'll want to indicate in the Fund Name (only used internally) whether it is for students or parents/others and then ensure the Fund Sub-type matches. The key to this method is to leave the fields in the Private Loan Option section of the fund parameters blank.

When you make an award to a student, select the student private loan fund if the student is the borrower or select the parent/other private loan fund if a parent or other individual is the borrower. Once the award is on the student’s record, navigate to the Packaging > Private Loans page and set the guarantor, lender, and program for the individual award there.

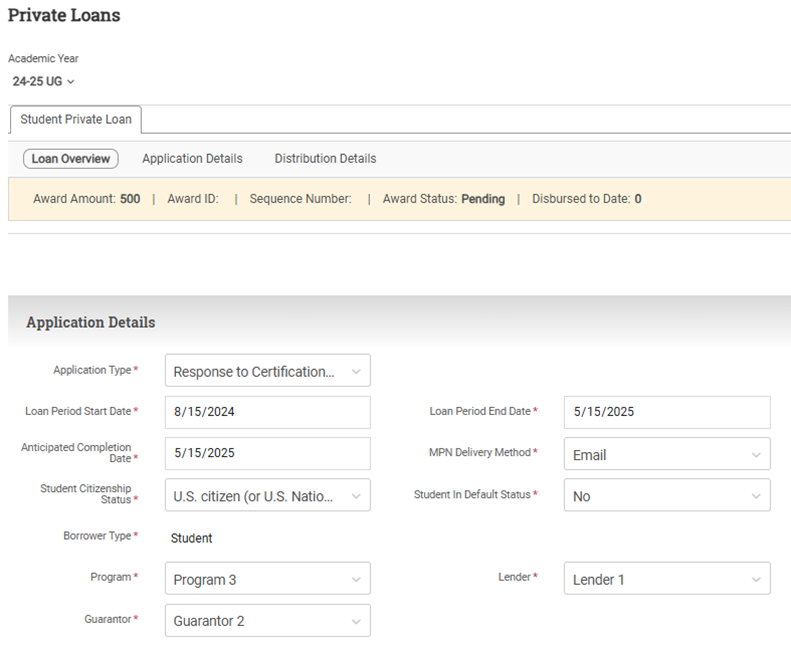

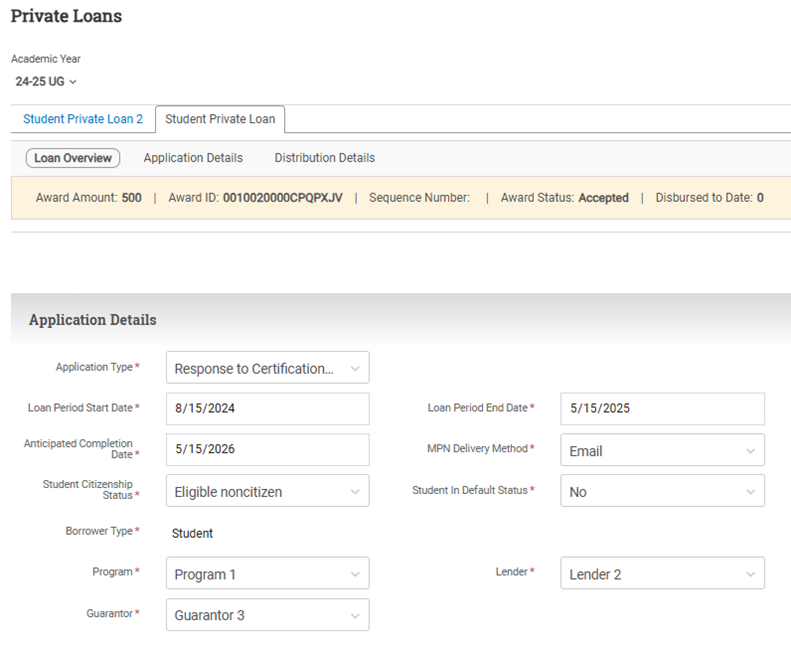

Using this method, let's assume Student A has applied for a loan in Program 3 from Lender 1 with Guarantor 2. Student B has applied for a loan in Program 1 from Lender 2 with Guarantor 3. In this option, you can award both of these awards using the same fund, the student private loan fund you created. Then once the award is saved, you would navigate to the Private Loans page in the student record and set the guarantor, lender, and program to match the certification request.

Student A:

Student B:

The main benefit of this option is that there are less funds you need to create. The main downside, however, is that there is more chance for human error as the program, lender, and guarantor need to be populated each time a private loan is awarded.

Option 2: One fund for each program

Use one fund for each private loan program. In this model, associate the program, lender, and guarantor to the fund directly. These values will automatically populate for any awards in the student record that are made from the fund.

In this example, you would create a fund for each program from which a student or parent/other borrows, and set the program, lender, and guarantor at the fund level. Then, when you make an award from the fund to a student and save, those values will automatically populate on the Private Loans page in the student record.

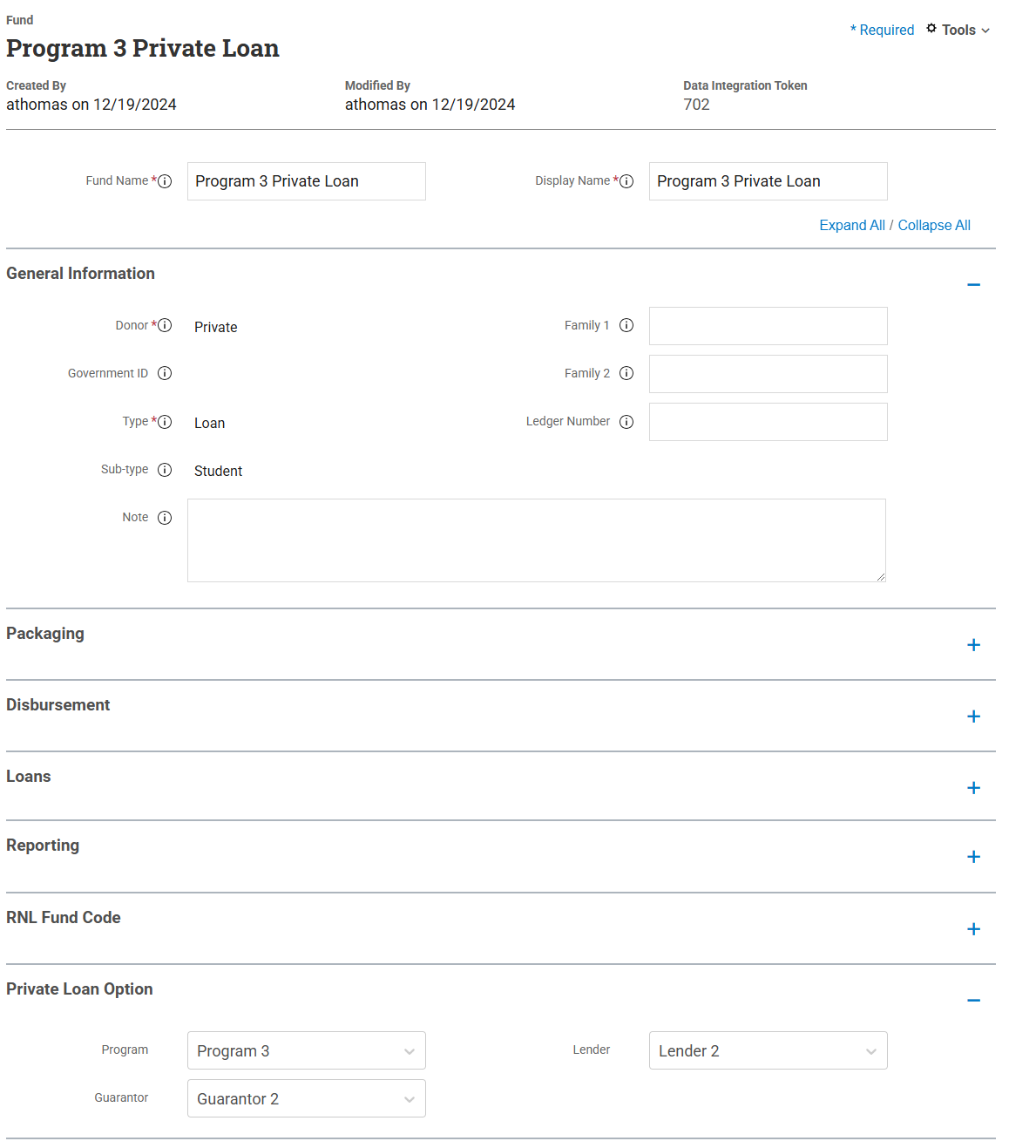

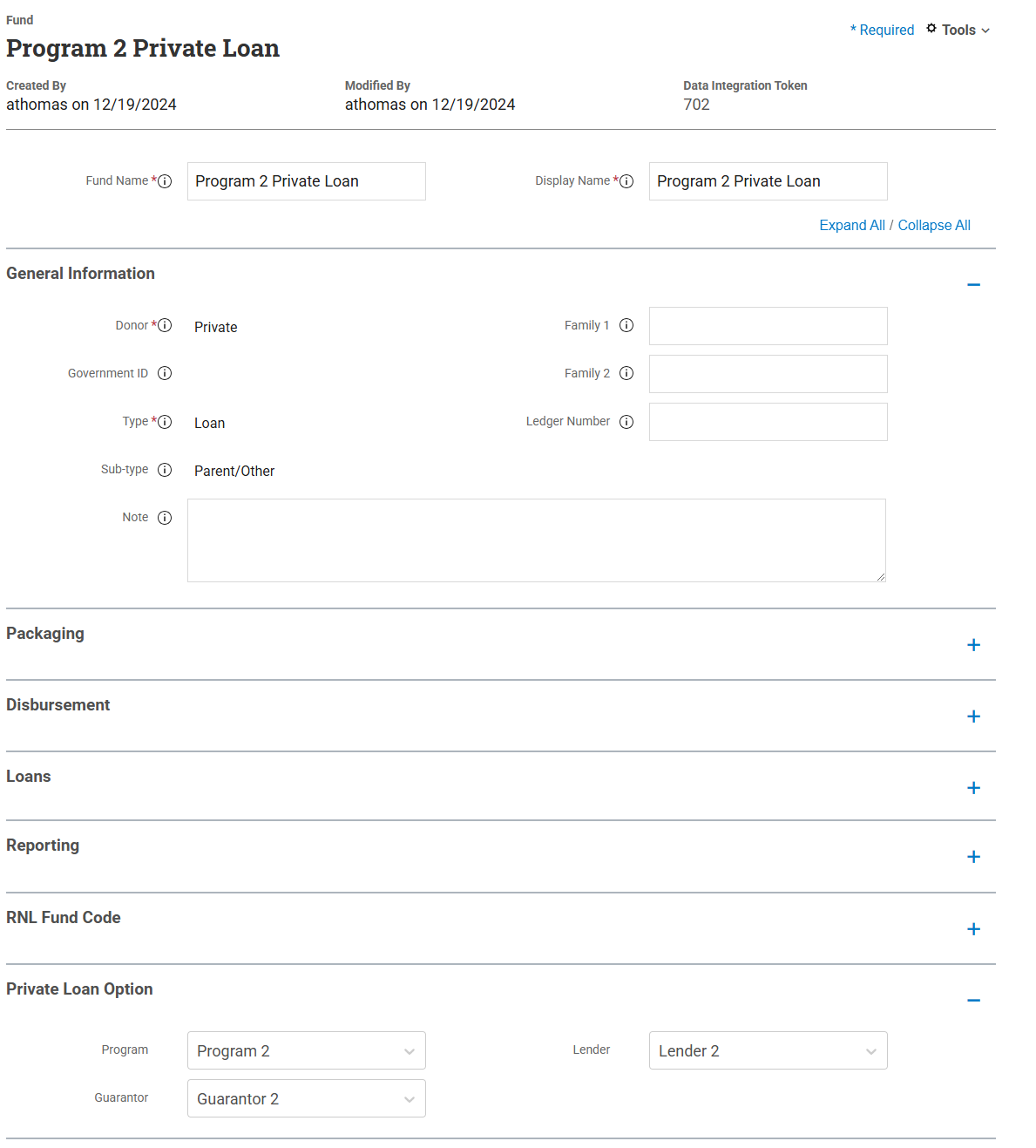

Using this method, let's assume you get a certification request where a student is borrowing in Program 3 from Lender 2 with Guarantor 2. In the same file, there’s a second loan for the same student where the parent is borrowing Program 2 from Lender 2 with Guarantor 2.

Since you’ve never had a student or parent borrow from these programs before, you would navigate to System Administration > Packaging > Funds and create new private loan funds, remembering to set the internal name and sub-type to match the type of borrower (Student vs Parent/Other). In the Private Loan Option section of each fund, you would then set the program, lender, and guarantor to match what's on the certification request. When you award the student from these two funds, these values will transfer over to their Private Loans page in the student record.

Student Private Loan:

Parent Private Loan:

The main benefit of this option is that there is less room for human error because the program, lender, and guarantor are populated once at the fund level and don’t have to be entered on each student record. The main downside, however, is that you could end up with many funds, including some which could be single use if only one student or parent/other borrows from that program.

Option 3: Combining Options 1 and 2

You may find that you actually want to combine Options 1 and 2 noted above, to create individual funds for the programs used most by your students but also have generic funds with no program, guarantor, or lender that can be used for smaller programs. When working with the latter, you must remember to set the program, guarantor, and lender on the student record.

The main benefit of this option is the flexibility it provides. A potential downside, however, is that you must remember which funds will automatically populate the program, lender, and guarantor and which you will have to manually populate. You may want to consider an internal procedure for noting this in the fund name.

In any set up, the sub-type should be Student for private loans where the student is the borrower and Parent/Other for private loans where the borrower is not the student.

For more information, see Creating and Editing a Fund.

Awarding

To award a private loan, add a new row to the student's aid package and select the private loan fund you created, then enter the amount and status, and then save. Ensure you are using a private loan fund with the appropriate sub-type based on borrower (where the sub-type is Student for student borrowers or Parent/Other for non-student borrowers).

For more information, see Packaging a Student Manually.

Borrowers

If the private loan borrower is not the student, you'll need to create the borrower record. No PLUS Application is needed.

For more information, see Creating and Editing a Borrower.

Private Loan Application Details

Details of an individual private loan awarded to a student can be found on the Private Loans page in the Packaging section of the student record.

When working with the data on this page, keep the following information in mind:

- All fields must be populated.

- For the Current Status field:

- Ready: Send Application: Use this if you want to certify the loan.

- Ready: Send Termination: Use this if the student applied for a loan but is not eligible to receive it.

- When terminating a loan, update the Application Type to Termination Response and select a termination reason.

- Ensure all fields are populated in the Application Details section.

- If you set up your private loan funds based on borrower, you'll need to select the program, lender, and guarantor.

- If you set up your private loan funds based on program, the program, lender, and guarantor are automatically populated.

- If the borrower is not the student, you'll need to select the borrower in the Borrower field.

Application Send Export (Certification Request)

If the recipient of your file is not ELM, Great Lakes, or Sallie Mae, you'll need to add the recipient name and ID from Import/Export > Private Loans > Export, by selecting the Manage Recipients button.

You'll also want to set up the global export options to reflect how you most commonly export private loans.

Once these two steps are complete, you can select Export Files to run the export process and create the file. The file can then be downloaded from File Manager to send.

For more information, see the following articles:

Note: Once this process is complete, all the editable fields on the Private Loans page of the student record will be locked for this loan. You can always unlock them and make updates if needed. In addition, the Distribution Details section of the page will be populated.

Response File Import

When you receive a response file from the lender, you can import it directly into PowerFAIDS. Doing so will update corresponding fields in the Loan Overview section of the Private Loans page of the student record. Importing this file does not update any award amounts on Aid Package or within the Distribution Details section on the Private Loans page.

For more information, see Importing Private Loan Files.

Disbursement Roster Import

When you receive a Disbursement Roster from the lender, you can import it directly into PowerFAIDS. Doing so will update corresponding fields in the Loan Overview section of the Private Loans page of the student record, as well as populate the disbursement information in the Distribution Details section.

For more information, see Importing Private Loan Files.

Note: If you receive a check or prefer to manually enter disbursement information, you can do so in the Distribution Details section on the Private Loans page of the student record. You'll need to manually set the Current Status to Disbursement Roster Received when you complete this step if you are enforcing the Private Loan Disbursement Rule (see the Disbursement Rules section below for more information).

Disbursement Rules

PowerFAIDS comes with a rule to ensure that private loans are not disbursed until the Disbursement Roster is received (as indicated in the Current Status field on the Private Loans page). This rule is set to Enable for All Funds for Disbursement Authorization as default, but is only applied to private loans. You can leave the rule as is or you can update to Disable for All Funds if you don’t want to enforce this rule.

For more information, see Disbursement Rules.

Disbursing

You can run the disbursement authorization export process to disburse private loans so they show with a disbursed amount on the student's aid package just like any other award. If the disbursement rule for Private Loan Disbursement Roster Received is set to enforce, the private loan will not disburse unless the Current Status field is set to Disbursement Roster Received. Once the disbursement authorization process is complete, the Current Status field will be updated to Disbursed.