Rounding Rules

Because not all funds use cents, rounding rules must be applied when distributing funds across multiple payment periods, or across multiple distributions within payment periods.

Any necessary rounding is done in an alternating pattern by first rounding up and then down starting with the earliest payment period and proceeding in date sequence order. Any remainder is then added to the last available payment period. This pattern is again repeated if any rounding is needed for multiple distributions within a single payment period, with any remainder added to the last available distribution within the payment period.

For the Pell Grant fund only, this rounding pattern will reset whenever the enrollment status changes between payment periods.

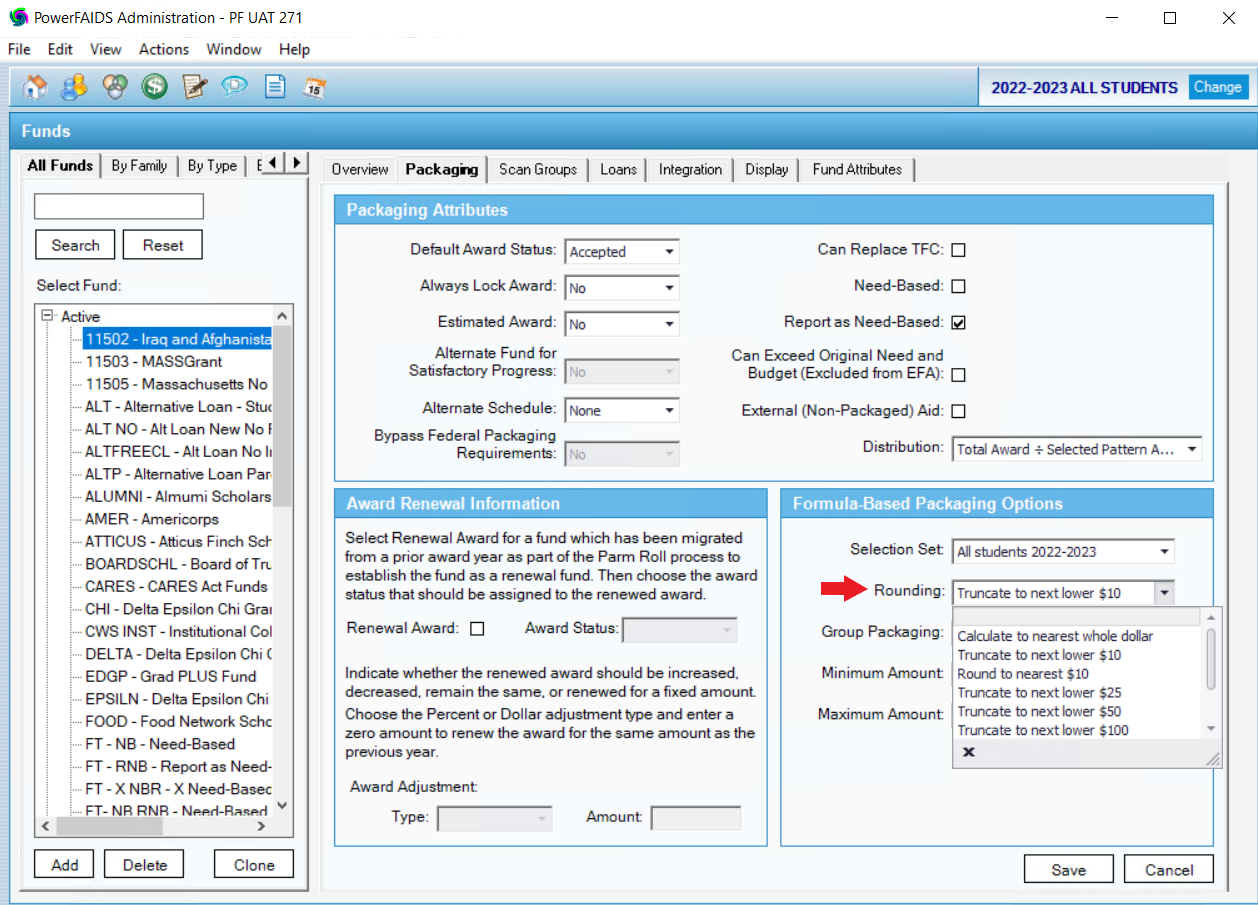

Note: For users of previous versions of PowerFAIDS, rounding rules were previously specified by the user in the Rounding field in the Packaging Attributes section of the Packaging page.

Examples of Rounding in PowerFAIDS Cloud

Perhaps your institution divides its academic year into trimesters and distributes a $5,000 federal need-based grant to eligible students equally across three payment periods using the Total Award / Number of Payment Periods distribution option for that fund. In this case, the rounding pattern for distributing that fund to a student would work as follows:

| Payment Period 1 | Payment Period 2 | Payment Period 3 | Total |

|---|---|---|---|

| $1,667 | $1,666 | $1,667 |

$5,000 |

Because 5,000 ÷ 3 is 1,666.67 and this fund does not use cents, the first distribution for the first payment period would be rounded up to $1,667. Then, because rounding in PowerFAIDS Cloud is done in an alternating pattern, the second distribution would be rounded down to $1,666. To calculate the amount to award the student in the third and final distribution, you would round up again, then add any remainder. In this case, after rounding up to $1,667, the sum of the three distributions equals $5,000, so the final distribution would be $1,667.

Perhaps your institution divides its academic year into semesters and distributes a $10,500 federal subsidized loan to eligible students across two distributions per payment period using the Payment Period Percent of Year distribution option for that fund. The first payment period takes up 47% of the academic year, while the second payment period is slightly longer and takes up 53%. In this case, the rounding pattern would work as follows:

| Payment Period 1 | Payment Period 2 | Total | ||

|---|---|---|---|---|

| Distribution 1 | Distribution 2 | Distribution 3 | Distribution 4 | |

| $2,468 | $2,467 | $2,783 | $2,782 |

$10,500 |

Because the first payment period takes up 47% of your institution's academic year, the total amount that needs to be distributed during that payment period is $4,735. This amount would then be divided across the two distributions within the payment period, with the first distribution being rounded up and the second distribution being rounded down. Half of 4,735 is $2,467.5, so the first distribution of this award would be rounded up to $2,468 and the second would be rounded down to $2,467.

The same pattern would be applied to the second payment period, but because the second payment period takes up 53% of the year, the amount being distributed in that payment period is $5,565. The first distribution would then be rounded up to $2,783 and the second distribution rounded down to $2,782. After summing the four distributions, the amount awarded across both payment periods adds up to $10,500. In this case, after rounding down to $2,782, the sum of the four distributions equals $10,500, so there is no remainder to add to the final distribution.